We have finally made it to the end of the “Organize your Finances” challenge! We are now on day 6. I have received so many emails from my readers (Thank you). I am so grateful that this challenge has helped so many of you out.

This week, we have:

and

Today I am sharing some Debt Free stories.

A glance back at

“ORGANIZE YOUR FINANCES WEEK”…

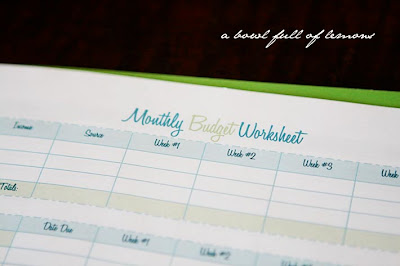

Day 1. Created a budget

Day 2. Started an envelope system

Day 3. Created a Budget Box

Day 4. Figured out our debt snowball

Day 5 – Dave Ramsey Interview

Did you keep track of your spending throughout the week? How much did you spend? Was it all necessary? Is there anywhere you can cut costs? Do you think you can start an envelope system to budget those expenses, so you can keep track and get spending under control? (Comment below and let me know).

DEBT FREE STORIES

I have a couple of readers who have learned how to manage their finances perfectly and are now proud to say that Lindsay is DEBT FREE & Katie is almost there! I hope you learn something from them. If you pay attention to those who are successful with their finances, you will GAIN priceless knowledge. Here are their stories…

Lindsay’s Story

I have been married to my wonderful husband for almost ten years. Four years ago we started our amazing debt free journey! We had always been blessed with a good income, and though we really were not living beyond our means, we managed to spend every penny we brought in, even as our income went up over the years. After our first child was born I had become somewhat uncomfortable with how were dealing (or lack thereof) with our finances and living paycheck to paycheck. I had mentioned it to my husband but in his eyes we were doing what was “normal”. This was how most Americans lived. We finally got the rude awakening I had been dreading in 2007 when a very large and unexpected tax bill came due. We had absolutely no money in savings and had one month to pay it. We ended up borrowing the money from my in-laws, which was embarrassing and we felt disappointed in ourselves. After all, we were supposed to be responsible adults. This is what really opened both our eyes and we decided we did not want to spend the rest of our lives like this. I had heard of Dave Ramsey but had never really read or listened to him. We both started listening to the radio show and signed up for the online FPU course, because there wasn’t a class anywhere near us. We started Dave’s plan in April 2007. We got gazelle and sold my husband’s gas guzzling truck that had a payment and got a beater 1997 Honda Civic for cash. We also sold my husband’s 4 wheeler and put our money pit of a rental property up for sale. But the biggest change we made was we got on a budget and told our money what to do! Before we had no idea where any of our money was going! Now we didn’t spend a dime unless it was in the budget. Between selling those items and A LOT of hard work and budgeting we were debt free by May 2008!! You can’t even imagine the feeling of being free of that debt! We felt like 1000 pound had been lifted from our shoulders. Over the last two years we have been in the process of saving for our fully funded emergency fund. We had to replace our beater Civic that started to smoke and then died! My husband had 2 surgeries, my daughter had 2 surgeries, we had our house flood, replaced our air conditioner, and we had our third child and I took 3 months maternity leave. We have always had money in savings during that time, we had just not reached the point of being fully funded. But through all the ups and down the last two years, we have felt minimal stress over our finances. We were financially prepared for the birth of our third child and my maternity leave, the other two we just “winged it” (which is a bad idea by the way)! And all the other things while they were inconvenient and annoying, were not catastrophes. I can not tell you how many times me and my husband have discussed how 4 years ago any one of those things would have put us in major financial strains and been horribly stressful. Now they just another bump in the road and we are thankful we have the money to deal with life’s little surprises. I can honestly say this is the best thing we could have ever done for our future and our marriage. Me and my husband are on the same page with our finances and so we work as a team rather than allowing it to cause friction in our marriage. We also have a plan for our future, which is very exciting! I am also VERY excited to say we will finish funding our emergency fund this month and moving on to Babysteps 4, 5, and 6!

Katie’s Story

My husband and I started Dave Ramsey’s Financial Peace University last April. Our motivation was that we had bought our house the year before, recieved the stimulus for it and put it aside to “help get us through the transition”. Well, by December we had blown through those thousands and had overdrawn our account, not by much, but still not good. We knew something had to change, but how. We had done “budgets” for years (I even still have them on my computer as a reminder), and we’d busted plenty of them. We had never made any real progress towards savings, college, or retirement and it was frustrating. We had a toddler and a 6 month old, so we were busy and broke, but my husband’s sister had told us about Dave Ramsey because they had done it. She was notoriously “free-spirited” and hated trying to manage money, so when I heard how well it was working for them I thought, “Okay, I guess it’s worth a shot”.

We borrowed the audio CDs and workbook from them and started listening, and it was FANTASTIC! We sat down and started doing the quick budgets, monthly cash flow plan, and working from an envelope system. We were fortunate (in some ways) that it came right around tax time, because we got to put our $1000 savings aside right away, your know, for when the bumper fell off the car because we started managing our money. When I sat down to do our monthly cash flow plan (aka budget) I had a pretty rude awakening. We were paying about a third of our income towards debt that WAS NOT our house every month, this also meant that based on our income, we didn’t really have money left for necessities (diapers…or maybe gas…or maybe food, YIKES!) after all of our “bills” So, we set aside another couple thousand to help us get through the next year as we started working the debt snowball plan, and getting gazelle intense about it (listen to Dave, you’ll get it).

Now, it’s only been a year and with Financial Peace, and we have not been able to call Dave yet for the DEBT FREEEEE!!!! scream, but I want to tell you all where we are because if we could do this ANYONE CAN. I won’t say that it has been a perfect year, either, although it has been relatively good to us. My husband’s job announced last summer that they no longer could afford to cover health insurance benefits at the same level, and that would have added another $300 a month to our stress load, but thanks to Dave’s info, we only had a small panic attack, changed the way we looked at health insurance and got on a high deductible plan with an HSA and are happily covered and in a BETTER place in that regard than before (funny how things work out). We’ve also had some surpise and not so surpise expenses that we were obligated to before Financial Peace, but those all got covered. All the while we started working on debt, by paying every bill, plus EVERY EXTRA PENNY we could squeeze from life in order to pay those off. I am a childbirth educator, so I have a very irregular income depending on who is pregnant and takes a class, but I won’t lie, that income helped. My husband and I also worked other jobs/overtime when it came up to be as gazelle as possible for the year.

When we started a year ago, I was hoping just to live successfully based on a plan, and if THAT could work than maybe to bring our bills down in a year to a place where we would at least break even every month and not have to rely on the “tax bonus”. Well, this year has been more than I could even dream. We have lived successfully on this plan, and we’ve even lived well. We’ve found ways to still have fun, see movies, go out to eat occasionally, enjoy life. We had Christmas, and yes I spent almost every penny of that budget (just $4.50 left over), but I had NO GUILT after Christmas, I spent exactly what we had planned for Christmas this year. A big thing to me too has been the actual Peace part of Financial Peace. I feel an incredible weight has lifted because I KNOW that we can manage our money and anything that comes our way from here on out. Also, it has been incredibly good for our marraige. I can remember the one “fight” we’ve had about money ALL YEAR, and it wasn’t so much a fight, but me being upset that my husband had spent $30 while I was out of town that we hadn’t planned on or talked about ahead of time. No biggie, we found another spot for that money to come out of, and it really was no big deal, it’s just become that easy and important for us to communicate about where our money is going. There is enough in life to stress us out, it feels so good to not fight about money anymore.

The biggest news out of this entire year is where we are at as of last Friday. Last Friday I paid off our last credit card and our last car loan, so as of last Friday we are consumer debt free! (we still have student loans, which is why we are not yet debt free). I could not believe it, I literally cried because it felt so good. In just one year we have paid off (and I added this up this morning just for you Toni) over $18,000 in debt! I can tell you that is on a moderate income. It’s crazy and if someone had told me a year ago that it would happen for us I probably would have laughed at them. This, also, more than covers that break even point as this reduces our monthly bills by about $475 A MONTH! I literally want to shout Dave Ramsey’s name from the rooftops, because it IS WORKING, and I know that Living like no one else means that we WILL Live like no one else someday…and probably sooner than I imagined. I share this information with everyone I can because I want people to know and experience this amazing feeling of success and peace, which is why I was excited to see it on Bowl of Lemons). So, think about it, what could you do with an extra $475 a month a year from now, or even better, what could you do if you had no debt? I’ll let you know how it feels in a few years when we get there!

I have one more debt free story to add today!!!

Amy’s Story

Back in 2008, several people we knew took the Financial Peace University course at our church. We saw it advertised quite a bit, but decided it wasn’t for us. We made good money and had no credit cards, so we thought we were doing quite well. That August, we found out we were expecting our first child. And, it seemed like everyone was talking about FPU. We decided to try it out, you know, just in case we ever found ourselves in financial difficulty.

As soon as the class started, we made our budget and really started sticking to it. We prioritized our spending and made LOTS of cutbacks. We went from eating out about 5-6 times a week to twice a month. Matt started listening to Dave’s radio show in the afternoons. One day, Dave mentioned that if you have a large expense coming up (like the birth of a child), you should stop the debt snowball and start saving as much as you can. Once the big event is passed and paid for, then throw what is left of that money toward your debt. We did this and over the next few months, we were able to save over $10,000.

In November, I got the opportunity to go back to my old job (I was in nursing school and not working at this time). I accepted because extra money is always great! The same week that I started, Matt got laid off from his job. What timing. That began 2 years of financial turmoil in the life of our family. Due to the recession, construction jobs, even corporate ones like Matt had, were virtually impossible to come by. He applied for everything he could think of. We even had to move out of our apartment and in with friends during this time. What was meant to be a “few weeks” turned into 5 months living in a spare bedroom. And, yes, that included not having a place of our own to bring our newborn baby home to. As a first time mom, it’s devastating to not be able to decorate a nursery and prepare for baby in your own space. But, how blessed we were to have those friends!

Because of gracious friends, my small, part-time income, and Matt’s unemployment benefits, we were able to save even during this time. Then, 3 weeks after the birth of our daughter, Matt’s dad passed away. He had owned his own business doing custom home building and remodeling. Within a few weeks, several of his clients were calling Matt to come finish what Roger had been working on. After a couple weeks of commuting, we felt that God was leading us to move for Matt to take over the business full-time. So, we packed up our stuff (which was already packed, in storage) and headed out here. We were blessed with the opportunity to live in Matt’s granddad’s house for just the cost of bills.

Soon, however, those jobs were complete and it proved tough to get much more work. Around the time I finished nursing school in December of 2009, our savings ran out. And, to add to that, I was unable to find a job. The nursing field was hit by the recession, as well. The answer I got from everyone was “we just don’t have the money to train a new nurse right now.” Even more, in January, we found out we were expecting another little one.

The next 7 months were some of the most stressful and horrible of my life, although they were filled with so much joy. Does that make sense? The stress and horror came from not knowing if we’d be able to keep the lights on day to day. The joy came from our marriage partnership, our sweet baby girl, and the growing baby inside me.

Even through all the uncertainty, God was good. Somehow, all of our bills got paid every month, even though we weren’t quite sure where the money was coming from. My daughter and I both got on Medicaid and we applied for food stamps. For the applications, I had to document our income and provide verification of it. I could document how much money we deposited into our account, but didn’t really know how to verify where it came from. All I can say is that God worked miracles during those times. Money literally came from Heaven.

Around the time that our second daughter was born, Matt started getting some work again. Not super steady, but work nonetheless. Life was still very tough and by the end of the year we were relying on Christmas and birthday money.

Then, the next miracle. The week before Christmas (2010) I applied for a job at a psych hospital. I didn’t really want to work psych, but it was a new posting I hadn’t seen before, so I thought I might as well apply. The same week, Matt’s uncle asked if he could start doing some work over there after Christmas. A couple days before Christmas, the Director of Nursing at the psych hospital called me and asked me to come in and visit with him. I went the next week and he hired me on the spot. I applied for this job on a whim, but ended up loving it! And, Matt has been overly busy with work since the beginning of the year. All of a sudden, when 2011 hit, we had more work than we could handle! Praise the Lord.

Because of Dave Ramsey and FPU, we made it through these past 2 years without adding a single penny to our debt. We worked hard and relied on God and He provided. And, no, I don’t believe that God EVER uses debt as a way to provide for His children.

Proverbs 22:7-The rich rule over the poor, and the borrower is slave to the lender.

Romans 13:8-Let no debt remain outstanding, except the continuing debt to love one another, for whoever loves others has fulfilled the law.

Because we didn’t dig our hole any deeper with new debt, we were basically able to pick up where we left off. We did have to redo Baby Step 1 and we have a few “catch-up” purchases to make (eye exams and glasses, things for the kids, etc.) but we are no worse off than when we started this journey.

The joy I felt when we transferred the last of our $1,000 into the savings account was amazing. Such a burden lifted off. Making our budget has become a fun time because we can actually put stuff on it besides electricity, water, gas, and food.

Had we not learned to live off less than we make and not learned what budget items are actually priorities, we would have come out of this trial with loads of debt and our 2 year emergency would have become a lifetime of financial devastation.

This is why I am so passionate about Dave Ramsey and Biblical finance. It changed our family tree and I hope and pray you will let it change yours.

By the way, when we moved and found a new church, Matt began the process of starting an FPU class before we actually joined. We are now in the 3rd semester of teaching it and we are so blessed to see it change other people’s lives like it did ours!

What inspiring stories. I CANNOT wait to share mine. My readers will be the first to know when I’m debt free! I hope you have all taken away some good tips from the challenge this week. If you follow the plan, hopefully one day soon you will be able to call Dave Ramsey up and shout “WERE DEBT FREE”!

GIVEAWAY WINNERS!!!

At the beginning of the challenge, I hosted a Dave Ramsey gift pack & Clean Mama budget printables giveaway. What an exciting gift to win… the possibility of cleaning up your finances and becoming debt free! Here are the winners:

The winner of the Dave Ramsey gift pack is…

If I were debt free… I would love to bless others who have blessed me buy slipping them $100 dollars here and there.

For example, my mom is in a nursing home and there is a nurse there who goes above and beyond. He works so hard and loves his job but I would like to thank him by giving him a little extra money.

That is just ONE situation I can think of.

It is so fun to GIVE!

For example, my mom is in a nursing home and there is a nurse there who goes above and beyond. He works so hard and loves his job but I would like to thank him by giving him a little extra money.

That is just ONE situation I can think of.

It is so fun to GIVE!

Congratulations. Please email me {here} with your shipping address.

The 5 winners of the Clean Mama printables are…

? Stacey said…

We are on our way to becoming debt free but am struggling to get it together and in a functional way. I am hoping that being debt free is in our very near future!

I am a follower 🙂

I so NEED to be debt free…it would rid so much stress for me and allow me to joy the things we have more 🙂

I so NEED to be debt free…it would rid so much stress for me and allow me to joy the things we have more 🙂

My husband listens to the Dave Ramsey show on the radio nearly every morning. We are trying to become debt free and will be dropping down to one income later this year when my husband starts gread school. We HAVE to track every penny we spend and try to put as much as possible into savings. When we finally become debt-free, my husband would like to buy a bass boat, and I want to re-decorate our entire home.

i’m so glad you are doing this this week. we are barely keeping our head above water in our debt. we are taking baby steps towards financial freedom. we need all the help we can get. this dave ramsey kit would be a godsend! i can’t wait to be debt free!

Jolayne said…

I am only 21 and I have about $30 000 in student loan debt (Thankfully I am a month away from graduating) and being newly married, it is definitely weighing on my shoulders. My husband is unemploymed at the moment so things get very trying at times. We haven’t been completely irresponsible with money, but we haven’t been the most responsible either. I look forward to when we’re debt free and don’t have this baggage on our shoulders. It’s hard to justify buying something when I owe so much. With this debt gone, my husband and I can move on and look forward to the future without burden 🙂

I am only 21 and I have about $30 000 in student loan debt (Thankfully I am a month away from graduating) and being newly married, it is definitely weighing on my shoulders. My husband is unemploymed at the moment so things get very trying at times. We haven’t been completely irresponsible with money, but we haven’t been the most responsible either. I look forward to when we’re debt free and don’t have this baggage on our shoulders. It’s hard to justify buying something when I owe so much. With this debt gone, my husband and I can move on and look forward to the future without burden 🙂

Thanks so much for these posts! I have heard so much about Dave Ramsey and look forward to learning more!

Please email Becky {here} and let her know you have won!

CONGRATULATIONS!!!

If you have participated in any of the challenges this week, please link up your blog to day 1 {here}. I would LOVE who all has joined in this week. I would also like to see your budget box pictures & envelope systems too. Way to go!

Tags: budgeting, Dave Ramsey, debt free, finances

Budget, dave ramsey, finances, Organizing Your Finances Series, weekly challenge Posted in

8 comments

Congrats to the winners!! I have LOVED this week. It came at such a great time too. The interview was awesome and I got some great ideas. Much wisdom coming from Dave. I linked up my new envelope system I decided to go ahead and start, and it’s already helping open our eyes as to how much we *really* spend on some things we didn’t really think about. I didn’t do a box, as a binder is working well for me. I moved it from the HMB to its own binder and it’s so much better now. This past week we paid off one credit card and my pickup truck! YAY! can’t wait to have more paid off and then post that we’re Debt FREE! It’ll be awesome and amazing! Thanks again Toni!

Toni, I really enjoyed the opportunity to revisit my family’s financial goals through your challenge this week! Thank you! And congratulations to the winners!

YOU are welcome!! Im glad you enjoyed it. I did too!

Thank you! I can’t wait to start using my printables. I know they willl help SO much!

Wow, these are inspiring posts! I’m new here and like what I’m reading!

My husband and I have been following Dave’s plan for a little less than a year now. We have paid off out ATV, car, and truck. Cut up all our credit cards and cancelled them as well. All we have left is my student loan and house, which we bought 4 years ago. We plan to pay off the student loan by October and the house within 7 years. Who thought you could pay a 30 year mortgage off in 7 years!!! It is a group effort though – my husband and I have to help keep each other in-line with the spending. We just have to remember that it is for the greater good of our budget. Live like no one else, so later you CAN live like no one else.

I am looking to start up my blog again. i am researching ideas – new ones and ideas that I have done and really like. I would love to post your organize your finances articles. Would that be okay? I am new to blogging and appreciate any advice you may have. Thanks so much.

Kristine, I dont allow my articles to be posted on another website, but you can refer to them and link back to my blog. 🙂