Today I am going to be helping you to create a “Debt Snowball” following Dave Ramsey’s Plan. The purpose of the Debt Snowball is to build on your payments, after you have paid a smaller debt off. This method will dramatically speed up your process to become debt free. I have been using this method for 17 months, and we are getting so close to becoming debt free ourselves!

Here are the details of the Debt Snowball:

Dave Ramsey’s Debt Snowball Plan

The principle of the debt snowball plan is to stop paying everything except minimum payments and focus on one thing at a time. Otherwise, nothing gets accomplished because all your effort is diluted. First accumulate $1,000 cash as an emergency fund. Then begin intensely getting rid of all debt (except the house) using my debt snowball plan. List your debts in order with the smallest payoff or balance first. Do not be concerned with interest rates or terms unless two debts have similar payoffs, then list the higher interest rate debt first. Paying the little debts off first gives you quick feedback, and you are more likely to stay with the plan.

Build Momentum

Redo this each time you pay off a debt, so you can see how close you are getting to freedom. Keep the old papers to wallpaper the bathroom in your new debt-free house. The New Payment is found by adding all the payments on the debts listed above that item to the payment you are working on, so you have compounding payments which will get you out of debt very quickly. Payments Remaining is the number of payments remaining when you get down the snowball to that item. Cumulative Payments is the total payments needed, including the snowball, to pay off that item. In other words, this is your running total for Payments Remaining.

Debt Free!

You attack the smallest debt first, still maintaining minimum payments on everything else. Do what is necessary to focus your attention. Keep stepping up to the next larger bill. After the credit debt is taken care of, you are ready for the next Baby Step in your Total Money Makeover.

Full article & credited source can be found {here}.

My Challenge for you today:

Look up all of your debt balances. (Once you have a Budget Box, this will be so easy to do). Write them down (with the balance) and place them in order of smallest to largest DEBT, on your debt snowball sheet. (Note: Its not smallest payment to largest payment). At the top of the sheet, write today’s date. Every few months, you will re-calculate your debt (with a new debt snowball sheet) and adjust according to your new payoffs.

Dave Ramsey’s Debt Snowball Instructions…

You can also create your debt snowball at www.mytotalmoneymakeover.com. Here is the link to the {printable} debt snowball worksheet, to use for this challenge.

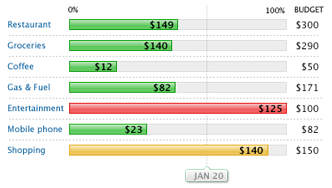

Another way of keeping track of your finances is to use an online budgeting program. If you do not want to go with Dave Ramsey’s cash envelope system, you might look into Mint! You can budget your expenses electronically. Mint.com is an excellent FREE program!

Here are a couple of video that explains how Mint.com works…

Mint.com really is a neat program!

Good Luck creating your Debt Snowball! I will see you back tomorrow to share the answers to your questions from my Dave Ramsey interview.

ps. I wanted to share one of my BFOL readers’ blogs. She has an excellent “organized finances” post {here}.

Tags: budgeting, Dave Ramsey, debt free, debt snowball, finances

Budget, budgeting, dave ramsey, finances, Organize, Organizing Your Finances Series, weekly challenge Posted in

16 comments

My husband and I are doing this, but what is hard for us is that we have a lot of large debts (school loans mostly) so it is a bit slow to cut it down (meaning years). I think this is a great plan.

I also recommend using Mint.com and I have the app on my Iphone. It’s really great and even sends me alerts and gives me my average of how much I spend on different things. Toni, all of this looks so great and it’s amazing not having debt – everyone should live within their means!! Thanks for all your help!

Becky B.

http://www.organizingmadefun.blogspot.com

Organizing Made Fun

Great plan. I am going to talk to the Mr. and see if he will do this!

Thanks and always love your site!

Dave Ramsey is awesome. My husband and I are debt free except for our mortgage since November 2009. The mortgage pay down IS going to take a while, but we are focused.

The best part of Dave’s plan is the impact it will have on your marriage. When you and your hubby are on the same page with your finances and goals and not fighting over money it makes your life sweeter.

As a FPU Graduate in 2006 I think we needed a refresher course! We had some backsliding and needed to get back on track.

My achilles heel is “I’ll just put this on the card and pay it off from our checking account later.”

Yeah, that never happens 🙂

I appreciate your timely prompts and reminders.

This is the BEST feeling and while it can be painful to face your “overall debts” – it’s also a feeling of relief when you have it all out, have a number, and a goal.

One word on Mint.com. I thought it sounded great but on more than one ocassion I received an email TWO WEEKS after a low balance or what have you. Fortunately I don’t use it to monitor accounts so there was no issue but I’m not sure how being warned 14 days too late that you have a low balance in X account or unusually large charges in another makes sense. Seems like a good service but if you are a new user I’d definitely keep an eye on it!

Thank you so much for this! We’ve done this on and off for years and had a goal of starting this in January but with unemployment and unexpected expenses we haven’t yet. I plan on getting this rolling with the first payments in April. I appreciate you sharing the simple way to track too – I tend to overcomplicate things and needed something simple. I might check out the mint program but I do have a system that is working for me in tracking what we spend/budget but can always use improvement too!!

Thanks for tackling a “scary” subject. I have been using Mint.com for about 2 months and I have already paid off 1 credit card…on to the next. I wasn’t one for a budget but I had to get serious and since it is only me and I have things I want to do I needed a plan.

Thanks again

My husband and I made a debt repayment list on excel and it was so nice. Unfortunately, we had to put a hold on it and are now setting up a new one and hoping we can stick with it this time. We don’t have much debt, but need to get an 6 mos emergency fund set up as well!

great post! we did this with our debt when we had many separate bills (credit cards, student loans…MY we had a lot!) it really helped to pile ALL the past money onto the next bill.

I’m happy to report that in less than 3 weeks, we’ll only have ONE bill left besides the mortgage! wooo hooo! Go Snowball!!

I am loving this challenge. I just barley logged on for the first time this week today, but am so excited to go home and chat with the Hubs about this plan!

We currently use MINT.com and LOVE it! I hated keeping a budget before because I would always have receipts lying around and then I would have to spend the time inputting them. With Mint.com, we switched to credit cards that could link up with their site and now I no longer have to input anything. So easy! My budget does it’s own thing….let’s me know when I’m getting close or when I’ve gone over for groceries, gasoline, etc. I definitely recommend to everyone.

Like Becky said, the iphone app is great.

I’ve got to tell you, I am so glad you have done this challenge! My husband and I definitely planned to get out of debt this year and I’ve read the Ramsey book and had that in mind when I mapped it all out. However, things happen and we got off track, but this will really help me get back on track and really get the snowball rolling! We have a ton of tiny bills like medical stuff and small cards and I can see us knocking those out fast, instead of just seeing them piling up and reminders coming every month. Can’t wait!

Im glad you are all excited about this challenge. IM excited too. 🙂

Toni

I love Dave Ramsey! I’m glad you did a series on this. Lets all be debt free!

Glad I found your site!

We all want to be debt-free. To do this, we will need to take full control of our spending. Also, we need to regularly pay our outstanding dues so as not to incur interest charges. Looking for additional sources of income is also something to think about. By managing our finances wisely we will soon find ourselves debt-free.

Carlisa Lyndon