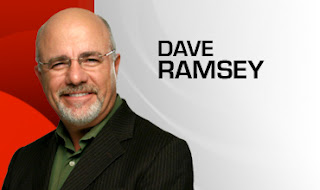

I am so excited about something I have coming up soon! I am going to be interviewing Dave Ramsey for my blog! I look up to him so much and I am just tickled that I am getting this opportunity. I am on his debt snow ball Financial Peace Plan… and have been for over a year. I can’t wait to be able to call him up and scream “I”M DEBT FREE”. Its gonna be a great day in my household, let me tell you.

Coming up soon on my weekly blog challenge, I will be hosting a “living on less & budgeting your life” week, and Dave’s plan will be part of it. During the challenge, I will also be giving away some Dave Ramsey financial goodies… and you will get a chance to win them! I love my readers so much and value your opinions, therefore I want to involve you with my interview. If you have any financial, debt or budgeting questions you would like for Dave to answer, please email me (here). I will choose a few of your questions to ask him. Your name will remain confidential, so please ask anything thats on your mind. This is going to be a fun challenge!

What do you want to ask Dave?

Budget, budgeting, dave ramsey Posted in 31 comments

I just wanted to say that four years ago we did this. We are forever grateful and wish we had done it years earlier. We now just owe for our house and are working at paying off our house earlier. This absolutely was the best thing…it changed our lives for the better!

OMGosh! I am SOOO excited for you! I have heard sooo much about him, but havent had the extra funds to purchase any of his books just yet, but I am working on it, it happens to be one of my small financial goals…I cant wait for the series!

:0)

We love Dave Ramsey! We did his FPU class a couple years ago, while I was pregnant, and it totally changed our finances. Our church offers FPU classes year round and I have seen it change so many of my friend’s lives, I love it! I’m excited for you to get to interview him, good luck!

I <3 him! FPU totally worth it and although we're not quite debt free yet, we are $24,000.00 closer and only $7,000 away from our debt free scream!!! btw Santa brought DS7 FPU jr and the Junior's adventure books. We homeschool, so that is now a part of our curriculum!

If I can think of a specific question, I’ll comment again–good luck, I know you’ll do just fine!

I love Dave Ramsey. Snowballed my credit card debt and am debt free in that aspect.

I am self employed. I would love to know his input on how to budget when your income varies from month to month. Any tips would be helpful to me and any other self employed bloggers.

That is EXCITING!!! What a great opportunity for you. My husband and I just started the envelope system and we have already made a major decrease in the amount we have been spending. I would love to do FPU, but it hasn’t been offered anywhere near me yet.

That is so awesome and I am so glad that this will be one of your challenges. I have never taken his class due to not having the funds to do so but have learned lots from what others have said, reading snippits of his book in the bookstore and, long before him, I read Mary Hunt’s info which is similiar. Right now, we are wroking on getting the “Snowball” rolling so we can get out of debt also. Can’t wait for this challenge!

I have always been in charge of my own finances until recently when my fiance and I decided to merge our accounts in preparation for the wedding. Does Dave have any tips for those of us who are “sharing” income for the first time? How to keep the peace, etc?

So happy for you!!! Tell him your readers say “HI!!!” My husband and I are currently taking his FPU class. We are in our 3rd week and we are excited!!!

My question would be this: I have a 14 year old that I have failed him in the money aspect. Is it too late to start teaching him? If not, how and what do I start teaching him?

Yay!! I love Dave Ramsey. My husband and I recently started his plan. I am so looking forward to reading your interview with him and your weekly challenge that will incorporate his plan!

Lucky girl! You deserve it…it is hard work! Great job being weird! We love Dave here too! We did FPU about six months ago and hope to be able to do our scream sometime next year. Our plans have been derailed recently due to my husband’s job but we are still working the plan the best we can and if it wasn’t for FPU and living differently I would probably be completely stressed out about the possibility of him losing his job!

I am very excited to read this interview. I have recetly been interested in Dave and his knowledge. He has helped so many people!

I am a young newly wed who has accumulated $30 000 in student loans and my husband brought around $13 000 and he is unemployed. It is definitely very over whelming.

My question for Dave is where do we start? It seems like a huge question, but we are worried.

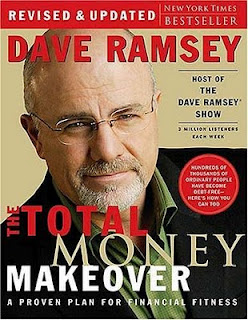

I am a HUGE Dave fan! I can’t wait to read the interview. I consider his Total Money Makeover book to be my finance bible 🙂

That is very cool. My husband and I are BIG Dave Ramsey fans and with dedication, the Lord, and his help we are now DEBT FREE! Its such a great feeling and love that you are motivating others to life their financial burdens:) Good luck witht he interview.

We are currently trying to modify our mortgage. It has been almost 7 months since we began the process and are running out of money now. We have never defaulted on a payment – ever. My question is, how much longer do we keep this up? We are using our credit cards for everything in order to have enough cash to pay our mortgage each month. We have always paid our credit cards off every month to bring the balance to $0 – but now we are running out of “cash”. Do we go into credit card debt for a few months in hopes that our modification will go through? (It has been “approved” but they won’t give us a time frame as to when we still start our trial payments, or what those payments will be) Or do we try to sell our house? We are very upside down in it like a lot of America. Unfortunately.

Thanks for opportunity to ask Dave a question!! LOVE your blog 🙂

I am a Dave JUNKIE! For my next birthday, I am asking my husband for Dave’s Financial Peace U instead of jewelry, ha ha. I have all his books and reread them every few months to fuel my financial spark, you know? They never get old. Go you for getting some interview questions!

I just ran across your blog and I love it! I am officially a new follower 🙂

My husband and I are getting ready to start FPU in couple weeks! We are so excited to snowball our debt and become one of the millions of success stories. I look forward to reading your interview!

this is so exciting. he is so awesome, i read total money makeover in like 4 days. i cant wait to pick up financial peace. i cant even think of a question to ask him that he hasn’t answered in either his book or his radio program!

xo

KATY

LOVE him! Borderline idol worship him! Ask him when exactly do we start to save for a house? We are almost debt free and we rent. Do we save for a down payment at the same time as saving for college? Is a mortgage a debt we are allowed to take on again?

OMG!! Dave Rocks!! How exciting that you get to interview him!! Ok here’s my question…I’m a single gal, living in an apartment. I will be debt free by the end of this year. After that, I’d like to start saving for house. How much should I save for a house that would be in my means (teacher salary)?

Your questions are awesome.. keep them coming! 🙂

Toni

That is such an awesome opportunity!!

This is the first time I’ve heard of this guy, but the words “debt free” and “money savings” instantly had me interested! My husband and I are young (22), and could definitely use some help in this area! I’m really interested in learning more!

I would love it if you would ask him is he would talk about paying off your mortgage early. Our only debt is our mortgage payment and we are already paying an extra payment a month. What else can we do to get it paid off early?

I have to admit I dont follow DR but I do and have been for a long time now working along side Mary Hunts (Debt Proof Living) plan.. In fact I have heard they are very similiar in outlays regarding to getting and staying outta debt

Heather asked our question. Mortgage is our only debt & we pay an extra 2 payments each year (broken down into monthly payments). Still it looks like it will be 17 years before the house is paid off. Our budget is very tight, but I would like to know if there is something we are overlooking that will help us pay it off earlier.

I would like to know what steps one should take if they find out that they are being laid off…

How might one go about eliminating debt on one income…

so happy you’re doing this – I’m really looking into buying his e-thingy, you couldn’t have done this at a better time. Tone

WOW, I can’t wait to hear your interview! I just posted my personal Dave Ramsey story! I read his book exactly one year ago and it completely changed my life! I recommend it to everyone. How exciting for you!

My question for DR-When can we “afford” private school for our children. We are at the step of saving 15% for retirement, but we would not be able to pay extra on mortgage, or put any other money away. We might even need to dip a little into our 4 month emergency fund.

I know you have already interviewed him, but sounds like you know him. so next time you connect the one question I have is it better to throw all extra $ at the house to pay it off as fast as possible or save for retirement and/ or college while paying off the house? Would love to know his thoughts on this.