Planning for a Debt-free Christmas

One thing that we know for certain: Christmas will be here in exactly 18 weeks. One thing that may not be clear: Who will be celebrating it free of gift-giving debt. It’s much more joyful and peaceful to move into and out of the holidays without having to worry Read More

Periodically Reworking Your Budget

You’re following a written budget – fabulous! You are totally on the right track.* But one of the facts of life is that nobody’s financial situation is static. There are fluctuations in income, new expenses, expenses that end, and changes in monthly bill amounts. Plus, children are born, Read More

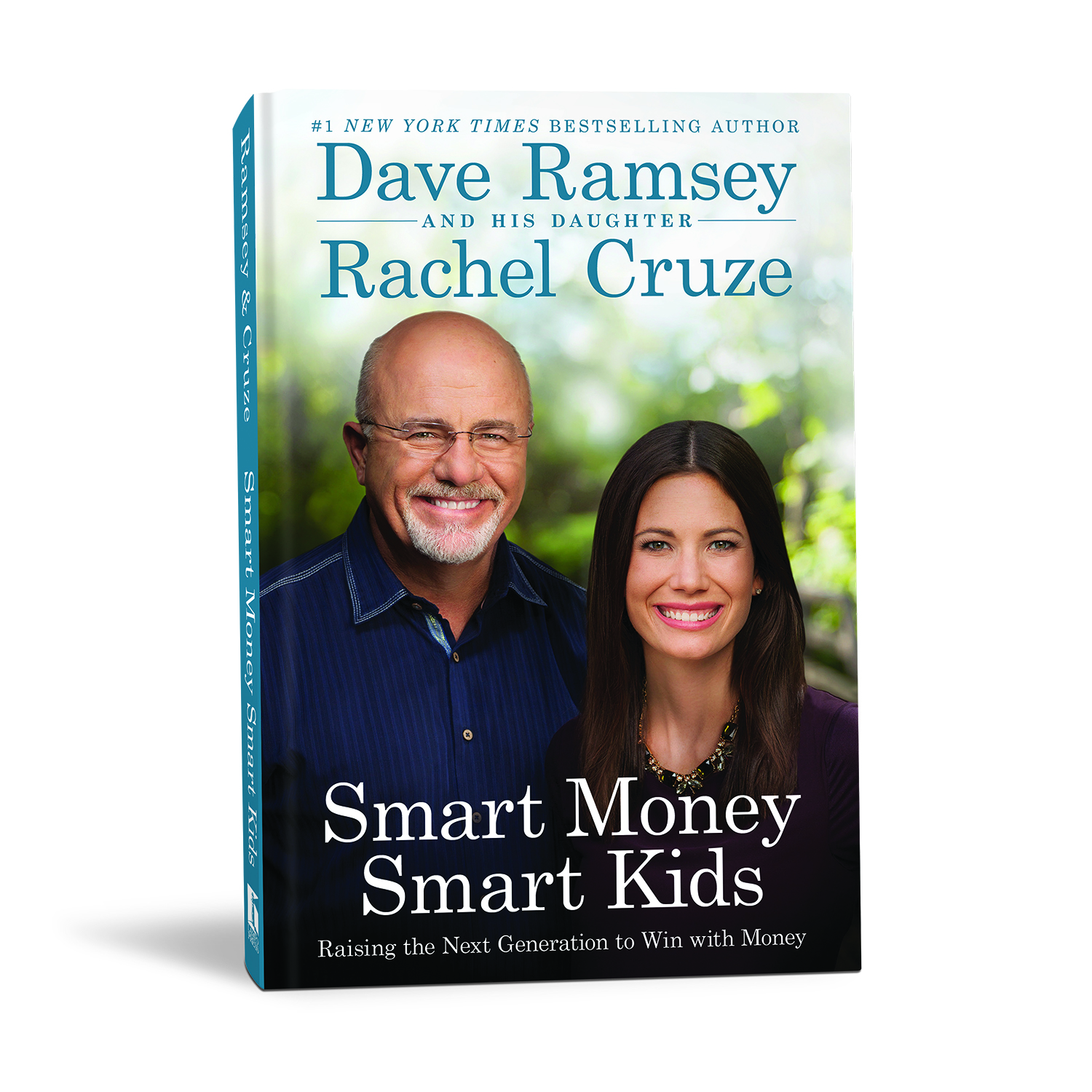

Smart Money Smart Kids…

Are you a parent who has yet to teach your children about money? Raising kids is scary and teaching them about money can be even scarier. This concept is forgotten among most families these days. Our kids are taught the dangers of drugs and alcohol, not to put their fingers Read More

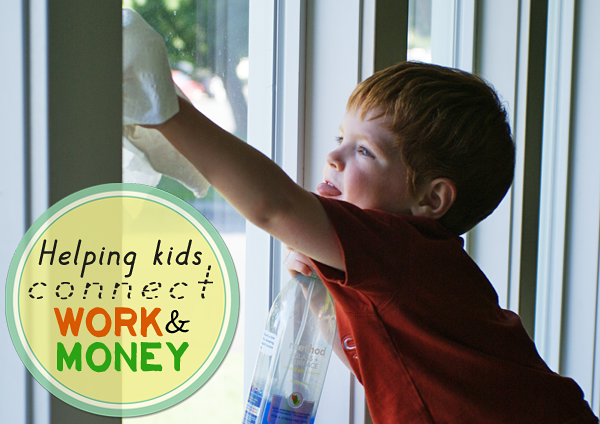

Kids and Money: Earning and Managing a Commission

In order to learn to manage money, kids need money to manage. (Yes, I know. I have a keen sense of the obvious.) And the way in which they receive and manage that money should fit as much as possible with grown-up reality since we’re not ultimately training Read More

Saving Your $1,000 Emergency Fund

via freedigitalphotos.net When you feel as though you’re living paycheck to paycheck, the thought of building up a $1,000 emergency fund can be daunting. But it’s so important, and with a little creativity it can be a fun and rewarding challenge! However, those dollars will not accumulate without a plan. Read More

Holiday Shopping on a Budget: Apps

Between Thanksgiving and Christmas meals, entertaining, and purchasing gifts, not overspending in November and December can be a challenge! Here are five apps to help you plan better, stick to your budget, and save money along the way. (Note: I do not own a smart phone but have been Read More

Budgeting for Fluctuating Bills

via freedigitalphotos.net When you’re on a tight budget, paying fluctuating bills can be a little frustrating or even stressful. Your natural gas bill might be nice and low in the summer and then skyrocket in the winter. And vice versa for your water bill. You can help your Read More

Household “Bill Payment Center”…

Bill paying can be a chore… a painful chore. But it doesn’t have to be. If you are organized and on top of your due dates & your budget, bill paying can be quite fun. Today I am going to help YOU set up a bill paying center in Read More