The first step to financial freedom is setting goals. What do you hope to accomplish? Where do you want to be in one year, five years, at retirement? Do you want to buy a home? My husband and I want to pay off our mortgage in two years and retire early so we are following the Dave Ramsey Financial Peace Plan. He has laid out everything we need to know to become financially independent. There’s no need to reinvent the wheel here. He has already devised the plan and it includes 7 financial goals (aka baby steps). My series will reflect these 7 goals.

DAVE RAMSEY’S 7 BABY STEPS

- $1000 in an emergency fund.

- Pay off all debt with the debt snowball.

- Add 3 to 6 months of expenses in a savings account.

- Invest 15% of income into Roth IRA’s and pre-tax retirement plans.

- College Funding.

- Pay off home mortgage.

- Build wealth and give!

MEASURE YOUR FINANCIAL GOALS:

Once you set goals, you’ll need to be able to measure them. This visual accountability will give you the fuel needed to keep going. I made it easy for you and created a Debt Free printable PDF kit so that you can easily measure your steps towards financial freedom. It’s only $10 and you can purchase it in my printables shop here. Keep in mind, you are not required to purchase this kit to follow the series. You can measure your steps on a piece of paper just as well. I like pretty things so this is great for me and it really helps me to achieve my goals!

THE DEBT FREE PRINTABLE KIT INCLUDES:

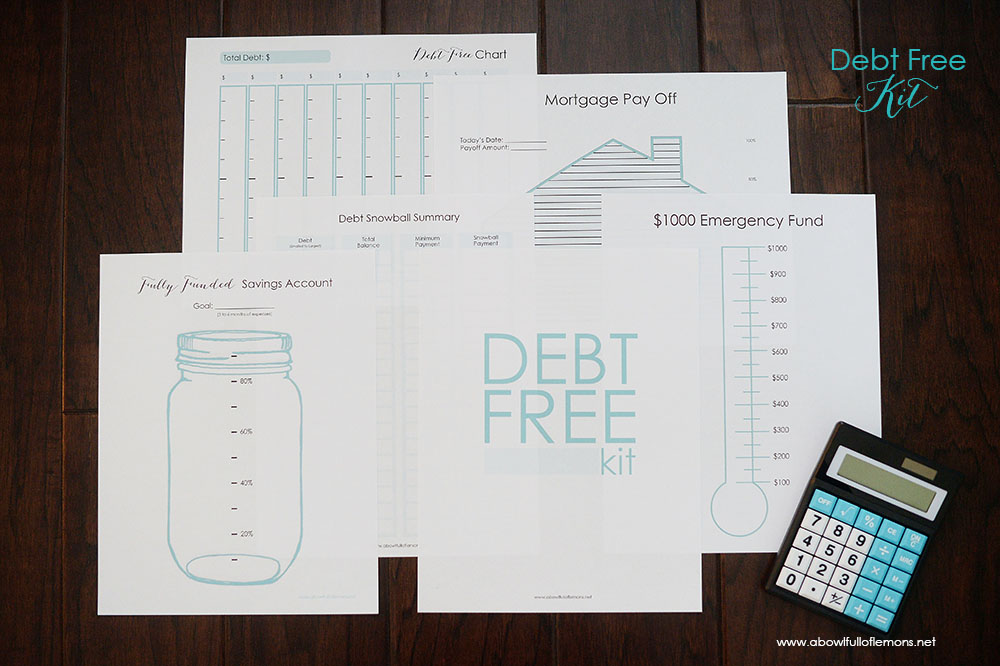

- $1000 Emergency Fund Goal Chart. The first goal is to save $1000 as soon as possible. Put it in a savings account and don’t touch it unless you have a real emergency.

- Debt Snowball Summary. Next it’s time to write down all debts from smallest to largest. Pay the minimum payment on everything but the smallest debt. Use all extra money you earn each month to pay the smallest debt off. Once it’s paid off, add that payment amount to the next largest debts minimum payment (snowball effect) and attack it with a vengeance. Continue this pattern until all debts are paid off.

- Debt Free Goal Chart. Transfer all debts from the debt snowball summary sheet to this sheet. Write the total amount owed at the top and the name of the debt at the bottom. Each month, fill in each chart with the amount you paid. Continue this every month, until all of your debts are paid off and you are debt free!

- Fully Funded Savings Account Goal Chart. Once your debts are paid off, it’s time to put 3 to 6 months of expenses into a fully funded savings account. Decide what your amount will be then fill in the jar every time you add money to this account.

- Mortgage Pay Off Goal Chart. After you’ve invested 15% to a retirement account and put money towards college funding, it’s time to pay off the dreaded home mortgage. Fill in the chart as you begin paying it off. Once you are debt free and have a fully funded savings account, all of your money can go towards paying down the mortgage. It will go faster than you think!

Visibility is key when setting goals. Make sure to place the charts where everyone can see them, either on the refrigerator, a door, or even a bulletin board. If they are out of sight, they are out of mind. Let your kids know what’s going on and help them understand. Set limits on spending and work out a zero based budget (more on that soon). If you follow the plan, slowly but surely, you will begin to see the fruits of your labor.

Visit Dave Ramsey’s website to learn more about the Seven Baby Steps and Financial Peace University. His plan is proven to work and I am living proof that it does. I highly suggest taking a FPU class. There may be one in your area. Click here to find out. Also take some time this week to write down your goals and create a plan of action. This is the first step to your new financial future. You can do it! I’ll see you back here on Sunday when I’ll go over how to create a written budget.

Disclosure: I am not affiliated with Dave Ramsey, nor have I gotten paid for this post. I am simply sharing what has worked for my family. I only share products that I believe my readers will love. I sell PDF printables so that I am able to share my love for organizing, cleaning, decorating, and budgeting with all of you. Without these sales, I would be unable to take the time to write these informative blog posts. So thank you for your support. I’m truly grateful. 🙂

Tags: budget, budgeting, Cultivating Financial Freedom, Dave Ramsey, finances

Blog, Budget, budgeting, Cultivating Financial Freedom Series, finances, September 2016 Posted in

18 comments

I am excited about this series and am happy to participate. Is there a chance you can explain how you handled the college funding part? It seems like you only started the Dave Ramsey program 8 years ago. How did you know how much to save for college? Did you use529’s? Also, if it’s not too personal, will you be paying 100% of college costs for your children or only a portion? This is the step we are on and looking at putting 2 children through college in the near future. I would love to know how others have handled this. My husband thinks if our children are responsible for a portion of this they may feel that they are more invested in it.

Hi Heather. I agree with your husband. My daughter is a freshman in college this year and we are making her pay $2500 per semester. We are paying the rest in cash (3 payments per semester). We want her to be invested in her college and understand that it doesn’t come without hard work. She had to get a student loan this year but when summer comes, she will be working to save for the next year and so forth – so no more loans. Since it took us forever to get our debt paid off, we never made it to the college savings baby step until now. Now we are now investing in a 529 for our younger kids.

Heather – Our family is on Baby Step 2. We have a junior in high school (11th grade), a freshman (9th grade and a 5th grader. What we are doing for college is paying tuition at a community college and they will pay for books. If they decide to enter a 4 year university, they will need to pay the difference in scholarships or their savings. My son is heavily considering the military so he can have access to the GI Bill and my daughter is considering that route as well, however she may be offered scholarships since she has a track record of a 4.0+ gpa. I hope this helps!

I am an empty nester and my husband and I have achieved financial independence, basically by always living below our means. Some of the ways we have been able to stay debt free have been: paying cash for cars and driving them into the ground, not taking vacations every year, eating at home, and not having to have the “latest” in technology or really anything. We do believe in investing in education – our kids got top notch college and post grad educations, NOT nice cars and the latest technology. One is now getting an MBA, one is in med school and one is about to start grad school – debt free because we saved. They all will have great jobs from the get go – a great return on our investment! And now in our late fifties, we do have nice new cars 🙂

I really appreciated your comments since we feel the same. When people tell me they couldn’t afford to send their kids to university, I don’t say much. But when they ask how we paid for our children to all go through university, I tell them we did without the vacations/boat/RV/new car etc. We are also in our late 50s.Because we made the sacrifices early on and chose not to life an elaborate lifestyle, we are able to make charitable donations and are quite comfortable. Everything comes with a “price” because we weren’t able to do everything we really wanted, it was the right choice for us. Our way of doing this is not everyones, but I believe our children are better money managers and have a better grasp of looking to the needs of others. Even if we had the money, we would have insisted on the kids paying at least partly for their own cars, phones, and leisure activities as well as giving to the less fortunate. It builds character.

The baby steps are brilliant – I’m already planning on paying off my mortgage, even though I’m yet to save for my deposit – it’s all about keeping your eyes on the prize!

I love that you are doing this series. My husband and I have followed this plan without even knowing about it ourbwhole married life, 11 years. With that said there are 2 things in Dave’s plan I don’t agree with. #1 waiting until you are financially free before you start to give! Of course I get the numbers but being charitable should not be saved for when you can “afford” to give. The widows mite is a great example of this principle! Giving from your abundance is not the same as sacrificing to give. It’s a faith building experience and shouldn’t be saved for the wealthy!

#2 paying for children’s college education. My husband and I both paid our way through college and graduated debt free. My husband was on a scholarship, but I received no financial help. It can be done! So of course because of our experience I will not be writing checks for my grown children. I will however help them find scholarships, internships, and teach them how to manage their money. I feel this is way more valuable then cutting a check! I’m expecting #5 any day now so I will have my work cutout for me.

My husband and I our currently working to pay off our mortgage too. We were mortgage free 2 years ago but decided to sell that home and purchase in a neighborhood that was better suited to raising our family. Though it put us back into dept I don’t regret our purchase. But being 100% debt free is really really nice, and i’m looking forward to that day again!

Actually Dave says to give before anything else first. http://www.daveramsey.com/blog/daves-advice-on-tithing-and-giving/. I think having kids pay for college isn’t a bad thing either. 🙂 Thanks for sharing.

Hi Toni,

New subbie here. Awesome blog! I, too, am a Dave Ramsey follower. I’ve started the plan more times than I care to admit because life hot on the way and I failed to plan went about things half-heartedly. I’m

hopeful that this time will be different. It is a bit more difficult (or maybe easier depending on how you look at it) because I’m single with no kids. I just recently paid off my car (9/9/16) and now all I have left is a small personal loan and a big student loan. I feel like this time will be different though because I’m tired of being tired. Thanks for your wealth of information that you provide!

Hi Toni,

Regarding Baby Step 4 do you invest 15% of income into Roth IRA’s and pre-tax retirement plans monthly from now on or just once? I know that may sound like a stupid question, but after all our debt is pay do we contribute 15% of our pay and they take what is left over and apply it to our mortgage?

Yes 15% comes out of each paycheck.

Hi Toni.

I paid via PayPal for your printables, but they didn’t come over to me. I used my work email (different than the one that will display here) so I could print – but I’ve got nothing. Can you help?

Did you get them?

Hi Toni,

Thank you for sharing your journey with all of us. Can I do this by myself? My spouse is not on board. I have heard on Dave’s show if both in it won’t work.

Any ideas?

Blessings!

Yes you can but it will take you longer.

Hello Mrs. Toni!

Thank you for sharing your journey with us. My question is with the baby steps do you do them one by one before moving on to the next step? Or are theyou all done at the same time?

I do multiple but it depends on your personal situation. 🙂

My husband and I did Dave’s FPU (Financial Peace University) and we loved it! Great system!