Budgeting & finances are not the most “exciting” task to accomplish. But if you get your finances organized, it can be more bearable. If you are struggling to pay your bills, or if you couldn’t tell me how much you owe on your debts, you especially need to go through this series. This week, I will be teaching you the vital steps to an organized budget. Yesterday, we assembled our Budget Binders. Today we are gathering account information.

To visit Day #1, Assembling your Binder, click here.

Day 2 – Record of Accounts

Today we are going to gather ALL of our debts/bills. This may take some time, but time well spent. The most recent statements will tell you what your current balances are. You want to collect those. If you cannot find your statements, call each company and get your balance as well as your account number and due dates.

Once you have collected all of your bills, now its time to gather the information from each of them. Write down on one sheet of paper (or use the “Record of Accounts” printbale if you have ABFOL Budgeting System):

- Account Name

- Contact Number

- Account Number

- User Name (For online login)

- Password

- Monthly Payment Amount

- Due Date

- Balance (If any)

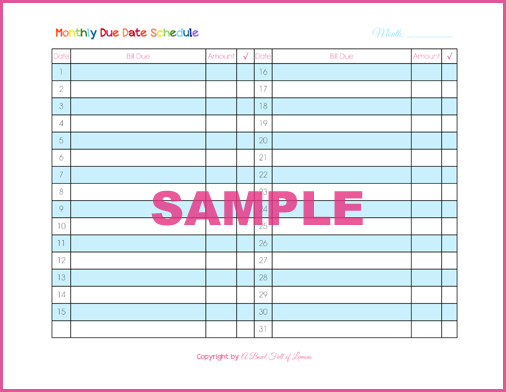

Now, with this information, Create a separate sheet labeled “Monthly Due Date Schedule”. (If you purchased ABFOL Budgeting System, This printable is called “Monthly Due Date Schedule”. Just fill in the boxes). This sheet is a collection of ALL bills owed each month & the dates they are due.

To create your own, write down numbers 1-31 in a column. Next, write down all of your bills on the designated due date. If there are 2 bills due on the same day, just move one bill a day ahead. It never hurts to pay a bill a day early, right? When you pay a bill, simply check off the date & write in the amount you paid. If you already know how much is due, you can write it in ahead of time. If the amount due fluctuates each month, you can leave it blank. Once you receive a bill in the mail, you can write in the correct amount. If you ever need to go back to see if a bill was paid, or what bills you have left to pay for the month, this page is a great reference. I refer to it often. It keeps me on track.

To summarize, today we gathered up all of our account information & created a due date checklist. Tomorrow, we will be working on income & debt trackers.

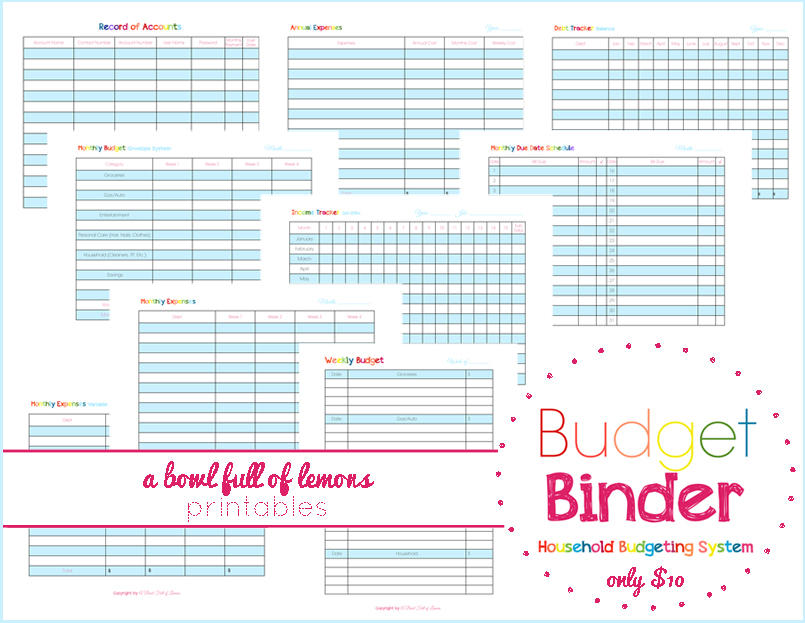

If you want to save yourself a lot of time, you can purchase A Bowl Full of Lemons “Household Budgeting System”. It’s includes everything you need to create a successful budget. This system goes hand in hand with my budgeting series. Visit (here) & take a closer look at the system. If you do not want to purchase, you can still follow along with the series and write out everything for your budget, on paper. It works just as well.

Happy Budgeting!

Tags: budget, budgeting, household budgeting

April 2013, Blog, Budget, Budget Binder Series, budgeting, finances, Household Budgeting Series, organize your finances Posted in

39 comments

I love the way you are organizing budget items. Unfortunately I am more of an electronic girl. Any way your sheets can be updated and saved on a computer?

MELISSA, If you have a Mac, you can edit these and Im assuming just use them on your computer. 😉

great, thanks!

Toni, do you now use this instead of your budget planner (Filofax)? Do you use both? It seems like to use both would be doubling your work. Would you clarify your method?

Kelley, I am using my filofax. 🙂 This system is great for anyone who doesnt have a filofax or is in need of a “budget” plan.

I am a new mac owner. Can you give a quick tutorial on editing

Are you writing down ALL bills? Like, electric, garbage pickup, magazine subscriptions etc.? Or just DEBTS?

ALL bills. 🙂

Toni,

Where do you keep your credit card statements, etc. & do you keep them for the whole year? You mentioned laminating your daily cleaning sheet & checking it off as it is done.

Do you have a laminator? If so what brand & where do I buy it? I love how you go step by step to help us get organized. Thanks so much for your help!!

Cindy

My cc statements are kept for 1 year then disposed. I do have a laminator. Its the scott brand from Target. 🙂

Toni, I am working on my budget binder…curious about a couple things…how to do you list things that are not paid every month? Under record of accounts, do you list the annual payment? Maybe Im getting ahead of myself, but Im confused. I need a Corona!

I have things that get pain every three months, and annually!

I will go over everything this week. Record of accounts- put the monthly payment. 🙂

What width of binder do you recommend?

1 inch. 🙂

I feel like this is a stupid question, but better asked than not asked! 🙂

The monthly due date schedule goes where? Logic says make 12 and put them in each month tab…

Does logic win bc you didn’t say where to place it OR I missed that.

Thank you, being the sole bill payer in the house made me realize if something happened to me, my hubby would be lost. He has no clue where the checkbook even is! Lol

Alison, I print out 12 and check of each month… but you dont have to. You can laminate the sheet as well. I like to keep it for my records to know what I paid. I keep mine in “due dates” tab.

That’s what I thought 🙂

Awesomeness! Thank you!

Toni, I use a Filofax to organise our finances but I am also giving this system a try (just recently purchased your Finance set) and so far I am loving it! Just organising all of our accounts made me realise how close we are to paying off our debt. Was a great motivator! Thank you for this series!

Hi Toni,

This may have come thru twice, sorry if so…I am not a planner / organizer, can you please help me with two questions: What do you do with bills that have varying monthly amounts due? And, what about seasona bills like lawn mowing, etc.? Thanks in advance!

Finally have some time to jump in on this series. Thank so much for doing this! I have a question that may be stupid but I pay a lot of my bills on-line through my bank. In order to make sure they get to the proper place on time, they get paid before the due date. Do you do this? If so, when you put the due date in your monthly due date schedule, do you use the due date from the company or use the one from your bank?

Thanks

I always put the date that its really due on the monthly due date schedule. I will mark beside the paid amount, the actual date I paid it on.

Toni,

What do I do when I have 5 or more bills due on the same day?

Hi Andreia, I would suggest printing out an extra page (or two) and log the remaining bills there. I’ll ask Toni about this and if she suggests something else, I’ll get back in touch with you. Thanks for stopping by and asking!

I have several bills due at the end of the month. I just put one on each day preceding. That works for me that way I pay the bill ahead of time. You could also add those 5 bills up and put the total in the box.

I would like to know if you are going to do this series again. My husband and I are empty nesters and never been on a budget My husband does not like budgets. So you can imagine where we stand with finances. Trying to get things oraganized and ready for retirement.

There is no plan to re-visit this challenge as of now. You can go through the steps on your own and we would love to have you join us in the Budget Binder Buddies group on Facebook. It’s strictly budget talk geared toward those of us using this particular binder but others are welcome to join.

I am going through this and realized that while you list the user name and password, the website should be listed too. I also took a screen shot of my security password questions and answers, printed it out and pasted it on the record of account for that company.

I just want to say thank you for this amazing tool. I just got out of a 10 years relationship with a person that took care of all the finances. This has helped me so much in getting my life together. I am on this site 5 times a day, truthfully everything has been a help but this especially!

Hi there – i have a lot of bills on “auto-pay” through my bank. Do you have any suggestions for how to work with that?

I would like the word editable version. what do i need to do?

these are only editable if you have a Mac.

Anyone can edit these budget binder printables. You do not need a mac. 😉

Where do I enter our investments? Such as RESP and RRSPs. We have direct debit for those each month, so what do I count that as?

I would list them in your record of accounts.

This post has me somewhat confused… Is the record of accounts bank accounts, accounts like for bills with electric company/water/internet company, etc., or both?

This is where you’ll keep a record of all your accounts; any and all.

Thank you so much for your love of organizing, I was really overwhelmed on how to manage everything to budget! I have my binder and ready to go! One thing I forgot was a hole puncher for my sheets! Sharing with everyone I know!

Thank you!