Day 3 – Income & Debt Tracking

In order to manage your monthly budget effectively, you should have a good idea of what your income will be. For some, this is difficult because your paychecks fluctuate. Keeping a good record of your income for the year will help. The best way to do this is by Income Tracking.

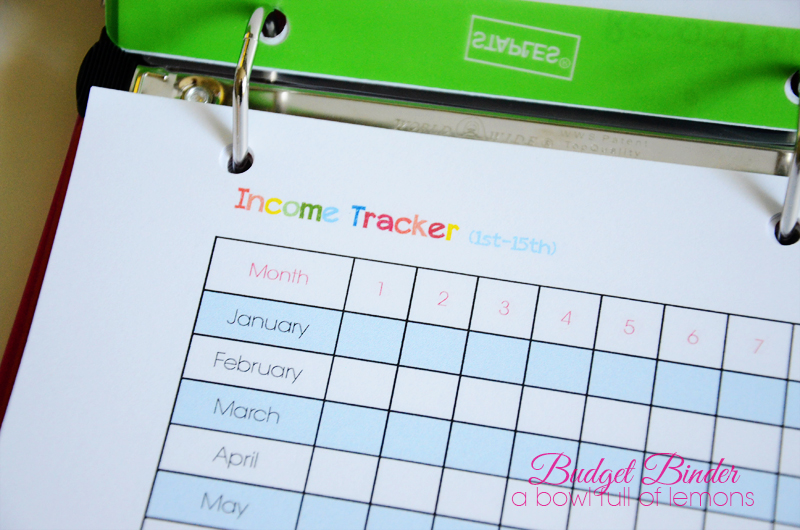

Income Tracker:

The “income tracker” organizes your pay checks from the 1st-31st of every month. If you purchased this printable from ABFOL Budgeting System, its a 2 page layout. Simply fill it out as you get paid. At the end of the year, add up each column (for monthly totals) then add the bottom row to show your net income for the entire year. Once you have this calculated, monthly budgeting will be much easier month after month.

My printed form is pretty detailed, but if you don’t have it, you can still track your income. It may be easier to designate one sheet of paper per each month of the year. To do this, take 12 sheets of loose leaf paper, write the month on top of each and number the rows from 1-31. When you get paid, write in the amount on the designated date (1-31). At the end of the month, add up the income and write it on the bottom of the sheet. You can also try to fit it all on two pieces of paper. Do whatever works best for you.

The purpose of these forms are to monitor and “average” your budget throughout the year. This will help keep you on “track”. Place this sheet in the “Income” section of your binder.

Debt Tracker:

The debt tracker is an ongoing monthly “balance” of your debt. When you are able to “see” what you are doing and how much you are paying down, you tend to want to do even more.

On a sheet of paper, create a column for your “debts”. Then create 12 columns (one for each month). (See my debt tracker sheet for the example). Each month, write in the remaining balance that you owe on your bills, after they are paid. This is my favorite budgeting sheet. I love seeing our debt disappear. Place this sheet in the “Due Dates” section of your binder.

Tomorrow we will go over Annual & Monthly expenses.

To start at the beginning of the Budgeting series, click below…

Day #1 – Assemble your Binder

Day #2 – Record of Accounts & Monthly Due Date Schedule

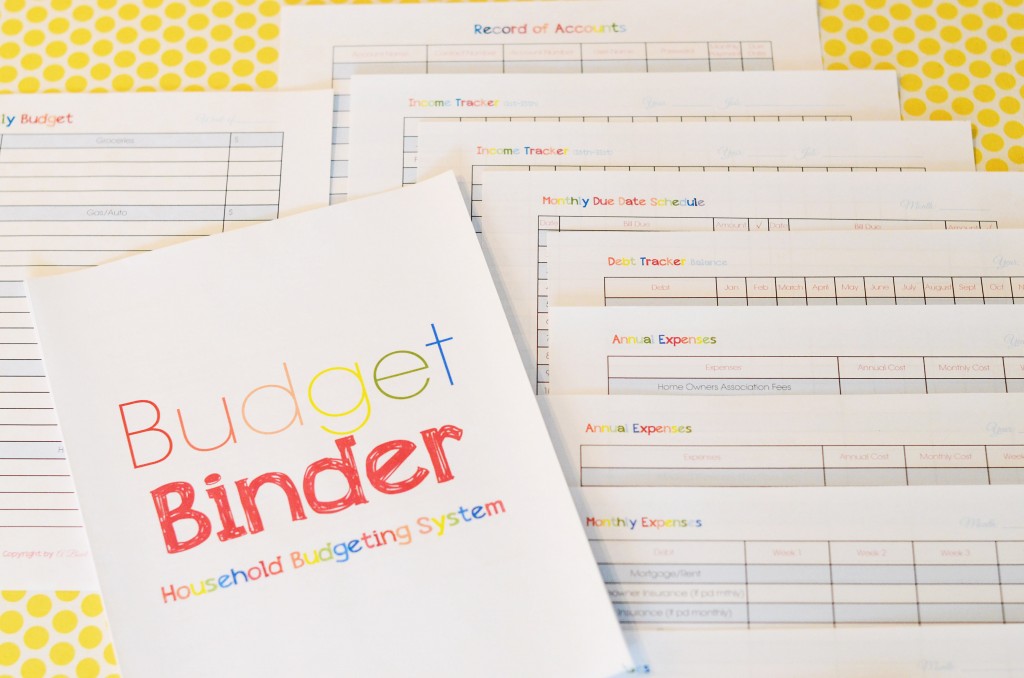

BUDGETING PRINTABLES

If you want to save yourself a lot of time, you can purchase A Bowl Full of Lemons “Household Budgeting System”.

It includes everything you need to create a successful budget. This system goes hand in hand with my budgeting series. Visit (here) & take a closer look at the system. If you do not want to purchase, you can still follow along with the series and write out everything for your budget, on paper. It works just as well.

Happy Budgeting!

Tags: budget binder, budgeting, finances, household budgeting

Blog, Budget, Budget Binder Series, budgeting, finances, Household Budgeting Series, Organize, organize your finances, Planners & Binders Posted in

23 comments

I might have to try this, see where I am at and all

I am graduating from grad school soon, and my boyfriend bought a house recently. I just wanted to let you know that these budget posts have been FANTASTIC for me since I’m just getting into the idea of serious finances. Thus far, all I’ve dealt with are rent-type bills, school bills, and groceries. The idea of having “real” money coming in and going out to so many places is mind boggling. I purchased your Budget Binder papers and put them together this afternoon, and I am feeling so much more in control and organized. Thank you!

Great post! Thank you for sharing all of your worksheet ideas.

KK

I think this is a great series 🙂 I love working on my finances (creating different budgets etc). I also love trying new methods!

I think this is really going to help me see where my money is going cant wait to get started using this .

Oh, I totally needed this. Thanks so much for sharing!

I have been working on a budget for the past several years and haven’t really found a great way to actually use it. Much of my budget is written on loose leaf paper and not really all in one place. These step by step instructions as well as the tips you give are great. Thank you so much for all your hard work and effort you put into this.

Just wanted to say that I’m following along and loving getting it all organized! Thanks so much for sharing your talents. I recommend your website to all of my clients, as a professional organizer. You are so inspiring.

Your printables are lovely! Thank you for sharing.

I’m so excited to start working on this budget. I have a question about tracking income. I’ve created two sets of the income track, one for my husband’s paychecks and one for mine. He gets paid every other week and I get paid twice a month so I think keeping them separate will help me keep better track. Anyway, how do you handle unexpected income, such as refunds or birthday money or tax refunds? Should I create a 3rd set so I can see it coming in but not include these amounts when I’m trying to budget? In going over our statements to enter our paychecks, I found quite a few of these non-paycheck deposits and I’m not quite sure how to incorporate them into the system. Thanks!!

Toni,

I just purchased these printables and am wondering if I can get the pdf and Word editable files sent? If I can only have one, I would like the editable Word document. I couldn’t find a place to comment when I sent payment via Paypal. Sorry for the inconvenience!

Jennifer, Please send a copy of your invoice to me and I’ll re-send the files. You may want to check your spam folder as they end up there from time to time.

~Rachel

Dear Toni:

I tried to purchase your budgeting system pages on Saturday, August 10, 2013. However, when I got to the paypal screen to make my payment, I got an error message. Due to this error, I thought that it didn’t process my order on your site. I really liked your pages so I gave it one more try. I got the same error from paypal. Consequently, I gave up and made my own pages.

Imagine my surprise when I found two receipts from ABOL in my email the next day.

Receipt Id: 3b5b064f7ff1b5ddf5f434781fc132c4

Receipt Id: 460c3678b097078443e2371806b4f494

I no longer need your pages as I’ve already invested my time and made my own. I didn’t download your pages. I know that there is probably no way to verify that on your end. Therefore, I don’t expect you to credit both of these charges. However, I would like credit for the second charge as I have overpaid for the pages.

Sincerely,

Glinda Sparks

Hi Glinda. I credited you back. Sorry about that!

Dear Toni:

Thank-you for crediting both of the payments. I had decided that after the failed second attempt that maybe God was telling me not to spend the money and make my own pages. Thanks for letting me keep that money for a needed expense.

Sincerely, Glinda Sparks

I know this is awfully late, but just in case: where do you file the debt tracker form? What tab does it go behind? Thanks!

Hello –

I am preparing to purchase the budgeting kit and wanted to know if the income tracker is editable? I get paid every other week and wanted to make sure I can keep track appropriately.

thanks,

Laila

all of the files you receive should be editable

Thank you!

I am a little confused by the income tracker. I am trying to make my own based off of the picture of yours, even though i cant see the whole thing. My question is: will there be a lot of empty spaces on these pages since pay days only come every two weeks(for us)?

Also, you meant to add up the ROW for the month right, not the column?

Sorry if these questions sound stupid but my pregnancy brain isn’t helping my normal confusion over this kind of thing. :/

correct to both. Although with the income tracker, you can use one page for 2 incomes. I have 4 incomes (5 if you include when I consign) and have a section for each income, but I could easily combine 2 or three of those to make things a little bit more concise. I like to see each income for itself and not mixed in. If I did combine, I would color coordinate.

My New Year’s Resolution is to get organized, and for the first time in my life, I’m attempting to set up a budget. I’ve been flying by the seat of my pants for years. I’m finding your organization tips wonderful. When tracking income, do I go by last year’s income to prepare a budget or do I start by plugging in this year’s income? This may sound like a stupid question, but its one I have to ask. :o) Thank you.

It is very helpful to know what you’ve spent the previous year but not necessary. If you can look ahead to expenses you know are coming (sending a child to camp, registration for your vehicle, 6 hair cuts/year, etc) you can plug them in and work from there. Knowing that you spent “X” amount on less common items will help you know how to budget for them again this year.