Today is our final step to setting up a household budget: Cash Spending. Our goal for this step is to create a budget for our necessary weekly spending. Over the last 4 days, we have completed the following…

Day #1 – Assemble your Binder

Day #2 – Record of Accounts & Monthly Due Date Schedule

Day #3 – Income & Debt Tracking

Day #4 – Annual & Monthly Expenses

Zero Based Budget:

The budget that I have shared with you during this series is called a “Zero Based Budget”. What this means is that you are assigning every dollar of your income to a specific category (whether it’s bills, groceries, or something in between). As Dave Ramsey puts it, you’ll be “spending your month’s income on paper” before you spend it in real life. This type of budgeting works well to pay off debt. It forces you to take control of your money. You are not letting your money take control of you. Ask anyone who has completed Dave Ramsey’s Financial Peace University and screamed “We’re Debt Free” how well it works. They will tell you it works really well!!

How much should you budget for Cash Spending?

Once you have calculated your monthly expenses (bills) you need to figure out how much money you have left & divide it into 5 categories. (To figure out how much money you have left, minus your monthly expenses from your monthly income). If you do not have enough money left to allocate to cash spending, you need to re-evaluate your monthly expenses. You may need to shut off the cell phones, cable, or sacrifice un-necessary things to get some bills paid off. You could also trade your car in for a less expensive model, etc. Of course, food & gas comes before paying your creditors, but you must be conscious of your spending habits. Ask yourself, “Am I living beyond my means?” If so, you need to either get another job or cut expenses.

Cash spending will vary from family to family, depending on your financial situation. If you are tight on money, you may need to cut down on your grocery bill, cook more meals from scratch, buy store brands, and clip coupons. Your cash spending will also depend on how many members are in your family. A family of 5 will require much more money in their food category than a family of 2. You have to evaluate your financial situation and determine what amount to set for each of these categories.

Envelope System:

If you’re really determined to pay off all of your debt, the envelope system may be a good choice for you. With this system, instead of using your debit card, use cash for the categories listed below. The envelope system is rumored to have been started during the Great Depression, when everyone had to watch what they spent very carefully. Having that same mindset today may not be such a bad thing. The key idea to using the envelope system is visualizing the money that you have to spend & separating it into different envelopes, then once it’s gone, there is no more to spend in that category until payday rolls around again (even if you have more money in the bank). It takes determination to stick to this type of budgeting, as it’s very easy to “borrow” from another envelope or take more cash out of the bank. If you truly stick to the envelope system, you will get out of debt a lot sooner (because the money that you are no longer “blowing” can be used to pay down debt).

Calculating your Cash Spending:

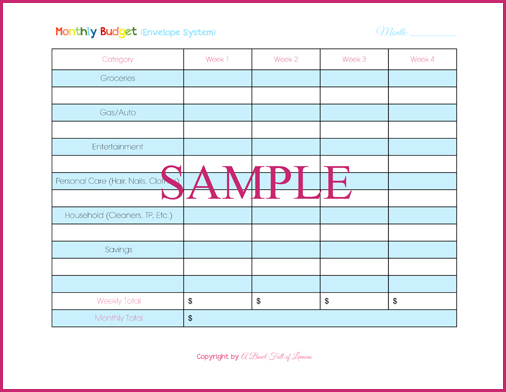

If you have ABFOL Household Budgeting Printables, the form you need to fill out today is the “Monthly Budget (Envelope System)”. If you don’t have the printables, on a sheet of paper, write down the 5 categories (listed below) in one column. Then beside that column, create 4 more columns. Write down “weeks 1-4” at the top of each of these columns. Calculate your spending for each category. If you are going to use the envelope system, write each category on a different envelope & place your cash inside.

Cash Spending Categories:

1. Groceries

2. Gas/Auto

3. Entertainment (Fun Money, Include dining out)

4. Personal Care (Hair, Nails, Clothes)

5. Household (Cleaners, TP, etc)

*What’s left over needs to go into a savings account or used to pay down debt.

Keeping Track:

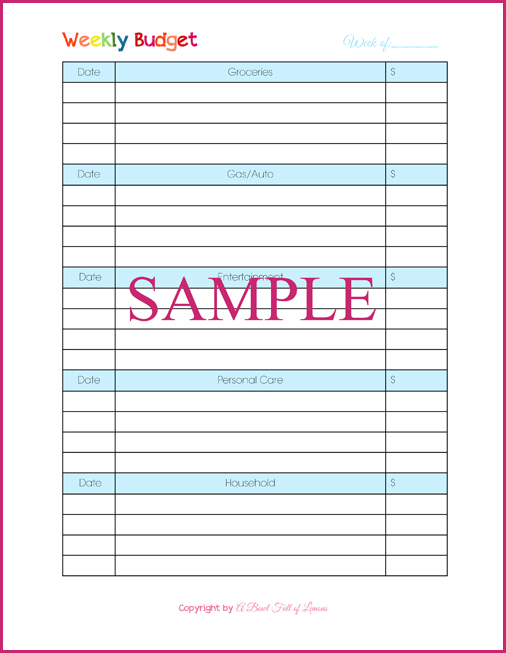

Use the “Weekly Budget” form to keep track of your cash spending. Write in the allocated amount at the top right of each category and every time you spend in that category, minus it from the balance. You can keep this sheet in your purse or with your cash envelopes.

Note: You do not have to follow a “cash” spending plan. You can use your debit card instead, although it will most likely take longer to pay down debt that way.

Conclusion:

Once you sit down and write out a budget, managing your finances won’t be so bad. You will feel more in control of your money & you will be less stressed. Budgeting is an ongoing process. You need to re-evaluate your budget EVERY MONTH. You cannot write out a budget and use the same one from month to month. It is guaranteed to change. You must be vigilant. Don’t give up. Set your mind to sticking to a budget. Pay off your debt and become free from the chains of your debtors. Its a beautiful place to be in. Thanks for joining me this week. I hope you learned something from my series.

Don’t forget to come back tomorrow to enter my “Budgeting” giveaway!! I have some fabulous prizes to shower you with.

BUDGET BINDER PRINTABLES

If you want to save yourself a lot of time, you can purchase A Bowl Full of Lemons“Household Budgeting System”. It’s includes everything you need to create a successful budget. This system goes hand in hand with my budgeting series. Visit (here) & take a closer look at the system. If you do not want to purchase, you can still follow along with the series and write out everything for your budget, on paper. It works just as well.

Tags: budgeting, envelope system, finances, household budgeting

Blog, Budget, Budget Binder Series, budgeting, envelope system, finances, Household Budgeting Series, May 2013, Organize, organize your finances, Planners & Binders Posted in

41 comments

Good Morning Toni!

Oh how I wish I could give you a great big hug and take you out for a Latte! (I hope you like coffee!) Your website is **FANSTASTIC** and I nominate you for WOMAN OF THE YEAR! Thank you so much for sharing all of your incredible wisdom and creating this site. You have not only motivated me, but my niece and daughter to want to become better budgeters, cleaners, and organizers. You are one stop shopping for all things INSPIRATIONAL. I have been scrambling to catch up on the budgeting series. I actually found you through ETSY looking for a cash envelope system and have been doign cartwheels ever since. Then when I saw you had a Pinterest account too, I wanted to call out sick from work so I could daydream and read your blog since the inception date and look at all your boards. I even went out in the SNOW (yes, welcome to KS in MAY!) to get my budget binder so I could get on track. THANK YOU, THANK YOU, THANK YOU for all that you do, having this AMAZING website, for helping the everyday people have guidance on how to get our act together. XOXOXOXO Nancy 🙂

Nancy, Im so glad I have been able to help get you on track! 🙂

Hi Toni!

I just purchased your budget binder system. Is it possible to get it in a Word version so that I can edit it? I can’t wait to get started! Our income has dropped by $1000 a month and we are in serious need of a budget.

Thank you so much!

Sure. I will email it to you.

I have really enjoyed this series and it has kicked my butt in gear to get my budget together. Thanks so much Toni!

I really love this post Toni!!! So well written, anyone can start a budget now with your help! I’ve been thinking about working on mine but never got around to it, now with this wonderful post I will definitely do it!!!

Thank you for your hard work, it’s really appreciated.

Lilian

Thank you Lillian!

Thank you so much for sharing this Budgeting series. I know you have had to put a lot of work into this. Due to work lay-offs and hours cut, I am having a very hard time just keeping food on the table and the electric on muchless trying to pay down debt. It is very easy to make sure every penny is accounted for because there is not enough pennies to pay my bills. I am finding it very discouraging as I work through this series, but I am determined to stick with it and do the best with what I have. Thank you again!

Don’t give up Tammi. You can do it!

Thanks for such a great series. I have a question about zero-based budgeting. Do people let their checking accounts get all the way down to zero? I’ve never understood how to do a zero-based budget and still leave a buffer in the bank.

Everyone should have a “cushion” in their bank accounts. Depending on your financial situation, it will be different. Use your best judgement. I keep a large buffer in my bank account. The rest goes to savings.

Thanks!

I have tried to stick to using the envelope system, but I just hate CASH so much. It never worked for me, I was always moving money between envelopes. I downloaded an Android app called “simplebudget” and it allows you to make digital envelopes and enter your transactions. This is my first month using it, and I’m hoping it will work well for me!!

Thank you for telling us about the Simple Budget app! I love it!

Thank you so much for this! I’ve been meaning to set up one forever and your instructions are so easy to follow.

Hi Toni,

It’s me Nancy again. I do have one question. On the Monthly Expenses form that you have week 1-4, how do you handle the months when there are five weeks in the month? I might be able to sleep tonight knowing I have my binder together 100%. Thanks for holding all our hands through this process 🙂

Warmly,

Nancy

I budget week 5 into the other 4 weeks & if its a “bonus” payday, it goes into savings.

We don’t have any debt right now (YAY!) but I have had a lot of trouble sticking to a budget. This is a great way to get a paper visual of where our money is being spent and where I can work and improve my spending. Thanks for putting this together! I had one question. What are the monthly tabs going to be used for?

I love this series I am bound and determined to to stick to a budget and get out of debtand have a little cushion in the bank. I love you ideas on budgeting, organization and cleaning I am so determined to get my house, budget and routines in motion . Thanks again I admire you.

So for each of the forms* that goes behind the ‘Monthly Budget’ tab, you need to print 12 of them, right? (to put behind the individual monthly tabs). Is that correct? Thank you so much!

*Monthly Expenses(Bills Due),

*Monthly Expenses-Variable,

*Weekly Budget*,

*Monthly Budget(Envelope System)

I waited until today to do all five steps, so I’m a bit spaced out right now, so forgive the questions. I’m probably missing something very obvious! First of all, once you figure out your annual expenses and your monthly expenses, and tally all of that up, that is pretty much your monthly budget right? I’ve gotten a bit lost at this point and am unclear about the monthly tabs we put into the binder. Should I be putting a new budget together for each tabbed month? What I find so frustrating when ever I work on these types of projects, I see that there should be plenty of money left over each month, on paper anyway, but in reality we always end up short. Should we just be trying to spend cash as much as possible instead of using our debit card? No matter how many times I sit down and do something like this, I just can’t seem to keep it all straight! Your tutorial has been very, very helpful, so here’s hoping, but I guess I still feel a little overwhelmed. Any more insight would be great. Thank you so much!

Thank you for a wonderful system for sorting out our budget. I am also going to start tracking medical expenses on a sheet, to make sure i budget for my medicines correctly. I always end up not adding enough to my FSA, and your system inspired me to track my spending to make sure its covered next year in my FSA!

Hi Toni,

Do you track the amount of money you have already spent or not of your annual expenses? I mean, If I save $1000 for all birth parties over the year, and use $ 300 on February, $ 300 on June and $ 400 on October. Do you have some way to track it?

I add it all up and divide it by the # of paydays. Then I put it in a savings account and take out what I need for each party. 😉

Thanks!

That’s what I tought.

I am thinking about making a planner an note down all party plans and expense. Maybe it is going to help me.

Thanks for all of the hard work on this website. My mum enjoys going through investigations and it’s easy to see why. A number of us hear all regarding the powerful medium you convey very important items through this blog and even recommend contribution from others on this concern then my child is truly being taught a great deal. Take advantage of the rest of the year. You’re the one conducting a dazzling job.

You made some decent points there. I regarded on the web for the problem and located most individuals will go along with together with your website.

Just wondering if everyone counts their baby/children’s needs into these 5 categories, or if they happen to add an extra category just for things the baby might need? For example: Does a new car seat go into the auto? Personal? How do you budget for things like this? (In our case it will probably come out of of date night -not that we’ve had one in a while). Thanks for any feedback!

I would think that one could put place that in whichever budget category they want. We have a two year old and budget the few things she uses (pull-ups, clothes, etc.) into the same categories as what we would use them on. For example the clothes goes into the same “clothes” category as my husband and I would put our clothes in, and the pull-ups go into the same category as our toilet paper goes in. I think whatever makes it easier for you to follow is what you should do 🙂

thank you, thank you, thank you! I just finished my first week with this system and love it. I can see exactly where my money is going, and see some light (a little) at the end of the tunnel. My favorite part is the envelope system. It works, in fact I hate parting with it at the checkout.

I have 2 problems. I purchased the budget printables. The first problem is that I need them in a word document so that I can personalize them and secondly I saved them on my work computer and now can’t get them downloaded to my home computer. HELP!!! Thanks!

Robyn, can you send an email to me at :abfolassistant@gmail.com, please and I’ll see what we can do to help you out.

Go ahead and include a copy of your invoice for purchasing the printables.

thanks,

Rachel

I will immediately grab your rss feed as I can’t find your email subscription hyperlink or e-newsletter service. Do you’ve any? Please let me know in order that I could subscribe. Thanks.

Hi! I am trying to do this “budget” thing a little better than I have before, so I followed your guide and I have everything figured out amount-wise (just averages for the envelope system to try out, but I’m keeping track of every expense and will be able to personalize it better once we’ve kept track for one month), but how do I start implementing the half a bill per paycheck? Obviously different bills are due each pay period and we don’t have a ton of extra money to set aside (thus the budget lol) so how do I start splitting them up? In theory it would make things MUCH more simple and we wouldn’t be house-poor at the first of every month, but I can’t seem to figure out how to do that. Do I need to be able to pay a whole mortgage plus set aside half of the next one? The smaller bills are easier to do, but we have a mortgage and a rent so that’s a lot to have to set aside on top of the one due. I’m hoping I’m just looking at it wrong and you can tell me the easy answer that will make total sense :0)

Thank you!!

Hi Toni! I started working on a budget cause I’m trying to buy a house. And so far its been complicated. Your printable worksheets have helped me tremendously. I would like to do some editing . Is there anyway you could email me a word version? I would greatly appreciate it 🙂 Thank you

The printables are all in editable format.

Dear Toni,

I just came across your blog and have been stuck here, reading and organizing and reading again and planning for hours! I already loved systems and categories and organizing everything neatly before and there are still a LOT of things to learn, so thank you so much.

I do have a question for the budgeting above: I’d really like to use the envelope system as it seems to be a good method for a shopping-on-a-whim kind of person like me to keep track of how much I can or cannot spend on certain things. But my problem is the following: I work as a waitress and I get paid monthly but I get my tips at the end of each shift. So I cannot begin each month by taking, say, 300$ out of my account and putting it in the assigned envelopes because I need that money in the bank for my bills. Do you have any suggestions?

You may need to visit your budget more often than others with a more consistent income.

Thank You!! I have been stuck on this website for hours! Making notes! It has inspired me to organize EVERYTHING! I can’t wait to start this budgeting system! I have a feeling I will actually stick with this plan!

Hi, I am wanting to purchase the budget printables, however, I wanted to get them printed off at Staples or Office Depot. How do I go about doing this with the copyright? Thanks in advance!

send an email to abfolassistant@gmail.com and we’ll send you the form needed.