Day 4 – Budgeting Annual & Monthly Expenses

Today we will be going through all of our expenses to calculate the amount due each month (and payday). If the amount due varies each month, you can either leave it blank or estimate the amount for your budget (I estimate). Once you get the bill in the mail, you can write in the correct amount. Always use a pencil for your monthly expenses & Budgets. This list does not include budgeting for food, gas, and entertainment. We will go over that tomorrow. You should already have the “monthly” expenses calculated on your “Monthly Due Date” form from yesterday. Take those totals and create your budget. Today will be the most confusing part of setting up your budget, but if you can get through this, you will be good to go!

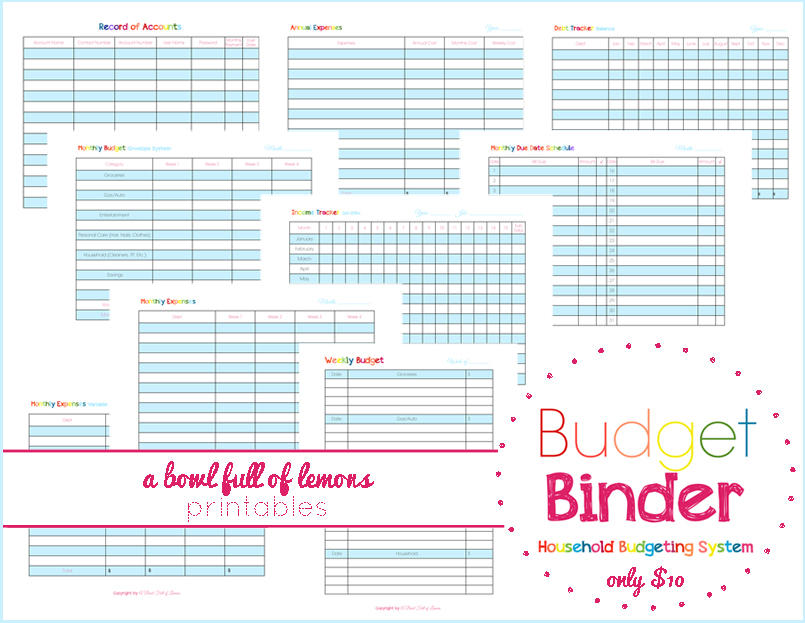

There are 3 forms you will fill out (or create) today, The Annual Expenses, Monthly Expenses Bills Due, and Monthly “Variable” Expense forms. If you purchased the Budget Binder Printables, these forms are all ready for you to fill out.

1. Annual Expenses Form

There are some bills or expenses that need paid less often (annually, bi-annually, etc…). We will figure out the “Annual, weekly & monthly” cost for them. On a piece of paper, write down all of your annual expenses (examples below). Now make 3 columns next to them (see Annual Expense form above). Label each column: annual cost, monthly cost, and weekly cost. Figure out how much you normally spend in each category. Fill it in. This is a good visual for how much we are actually spending on Annual monthly expenses. They add up quickly. You will carry these totals over to the “Monthly Expenses Bills Due” form (below).

Examples of Annual Expenses:

Home Owners Association Fees

Pet Fees

Car Insurance

Homeowners/Renters Insurance

Dental Expenses

Medical Expenses (Co Pays, etc)

Vacation

Easter/Christmas

Birthday Gifts/Parties

Memberships/Subscriptions

School Fees

Property Taxes

Auto Taxes

Pest Control

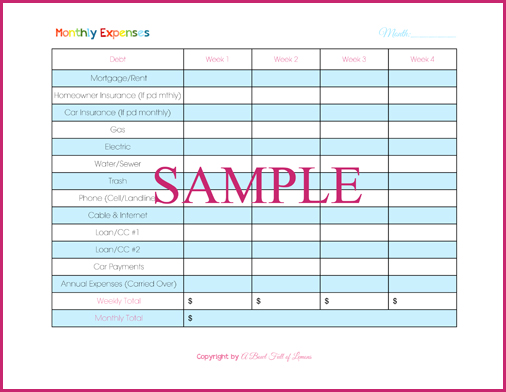

2. Monthly Expenses (Bills Due) Form

To Calculate your “Monthly Expenses” (Bills Due):

On a piece of paper, write down all of your monthly debts/expenses (in one column). If you are paid weekly, make 4 columns beside the bills. If you are paid twice per month, make 2 columns beside the bills. If you are paid monthly, you only need one column. See the picture above, for an example of how to set up your form.

Example: If you are paid weekly, take each expense and divide it by 4. For example: If your mortgage is 1000/month, divide it by 4 = $250 per week. Write down $250 in each weekly column. That is what you need to save out of each paycheck to budget for your mortgage. Do this with all bills and total each week at the bottom. Then you can total all 4 weeks to give you the monthly expense amount. If you budget this way, you will be averaging out all of your expenses so you will take out the same amount each payday. You will no longer have paydays where the money is gone because you had to take all of the mortgage out in one payday. This will alleviate the stress!

Examples of Monthly Expenses:

Mortgage/Rent

Homeowners Insurance (If pd monthly)

Car Insurance (If pd monthly)

Gas

Electric

Water/Sewer

Trash

Phone

Cable

Internet

Loans

Credit Cards

Car Payments

Annual Expenses (Carried over)

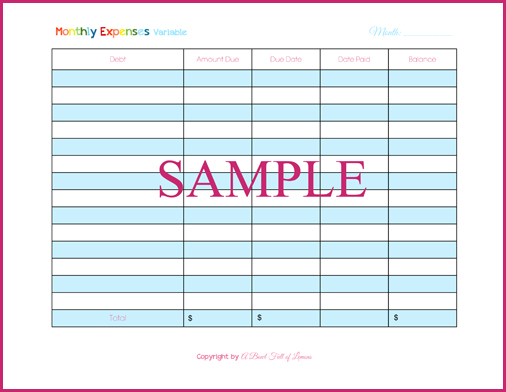

3. Variable Expenses:

If there are unexpected expenses that need to be paid, you can pay them by one of 2 ways. You can use money from your Emergency Fund ($1000 set aside for unexpected expenses) which is the preferred method, or you can budget them into your monthly expenses. To budget them in, follow the same directions as your regular expenses. Write them down on your Monthly Expenses form and divide by the # of weeks you get paid each month. To keep track of variable expenses that have been paid, you can write them down on a separate sheet of paper (see example above). Write down the debt, amount due, due date, date paid, and any remaining balance (in separate columns).

*Place the Annual Expenses form inside the “Annual Expenses” tab & place the Monthly Expenses Bills Due & Variable Expenses forms inside the “Monthly Budget” tab.

Keep in mind:

When you budget out your annual expenses with your weekly paycheck, make sure to “pay” this budgeted amount to a savings account. Do not touch this money. It’s so easy to “borrow” from this account if you are short on funds, but DONT do it! This isn’t an emergency fund. This is money already spent but just set aside. You should already have a $1000 emergency fund for unexpected emergencies.

Tomorrow we will be finishing off the series by setting up a monthly budget for groceries, gas, etc…

To start at the beginning of the Budgeting series, click below…

Day #1 – Assemble your Binder

Day #2 – Record of Accounts & Monthly Due Date Schedule

Day #3 – Income & Debt Tracking

BUDGET BINDER PRINTABLES

If you want to save yourself a lot of time, you can purchase A Bowl Full of Lemons“Household Budgeting System”. It’s includes everything you need to create a successful budget. This system goes hand in hand with my budgeting series. Visit (here) & take a closer look at the system. If you do not want to purchase, you can still follow along with the series and write out everything for your budget, on paper. It works just as well.

Tags: budget, budgeting, finances, household budgeting

Blog, Budget, Budget Binder Series, budgeting, finances, Household Budgeting Series, May 2013, Organize, organize your finances, Planners & Binders Posted in

17 comments

If I buy the budget printables, are the customizable?

Yes in word or apple pages.

Looks like you revamped your system from a few years ago. Just what I need I have fallen off the budget wagon and need to get organized again.

Hi Toni

I bought your budget printables and I thought they were only available in pdf format. Is there a way to customize them in word? Thanks for the inspiration this week and the printables were so worth it!

Yes, You can edit them in word. Email me your paypal invoice and I will send it. 🙂

Toni – I am considering moving in the near future, which will require a budget makeover. Do you have any advice regarding what percentage of monthly income the mortgage payment should stay under? I realize every situation is different, I’m just looking for a general guideline for consideration and it seems like you’ve got this budget thing under control 🙂

Dave Ramsey has budget percentage guidelines on his site. I haven’t looked for a while, but you may have to use the free budget calculator tool to see them.

Just wondering how to divide my paychecks. My husband is paid once a month and I am paid every other Friday. How do I divide it up as I am only part-time and so my checks are a lot less than my husband’s? Things like our mortgage if I divide say between 3 checks for each month would be very lopsided with my checks as they are a small amount. Make sense?

Sarah, I’m in the same boat! I’ve decided to use my whole income for now to knock down my debt, and my husband’s pay the rest. This makes some of the calculations easier. I may do two different sheets, one for him, and one for me, but haven’t got that far yet. Maybe designating y’all money will help y’all too? As long as it doesn’t cause issues later (I could see that happening in some relationships for sure!). Hopefully someone else will have more advice on this issue.

Toni- I am trying to get a grip on our finances and love your binder. We are paid bi-monthly. I like the idea of breaking our monthly expenses in half per paycheck so it is the same amount both times, but was wondering if you have 2 accounts that you work from to make sure that money is not spent on something else. Or do you pay each account twice a month?

I personally, use one account. If I need money set aside, I note it as ‘used’ in my checkbook ledger. For example, as I look ahead to Christmas and am starting to set money aside, I’ll make an entry: 7/2/13 CHRISTMAS -100.00 or whatever the amount may be. That way I see it as already spent. When it’s time to go shopping, I have that money in the account.

If you’re not comfortable doing that, you can use the envelope system, marking each envelop for its intended purpose and putting the amount needed (ie. mortgage $1000 1st- $500, 15th- $500) That way you know how much needs to be set aside with each paycheck that comes in.

I don’t understand dividing your expense and setting aside that amount. If I say divide my mortgage and set that money aside each week, then it will not be enough left to pay my bills for that week. Am I missing something?

At first it seems difficult (or at least it did to me). You need a month or so to kind of switch gears. Right now you’re paying what’s in front of you with what’s in front of you. You’ll have to work with your numbers a bit to save a little at first, set it aside so that you can switch over to dividing and setting certain amounts aside. It’s just another way of managing your money. It may work for some and not others.

I think I may have overlooked this, but what do you put in the 12 month tabs?

Perhaps I overlooked this as well. Are we making 12 copies of the Monthly Expense Sheet & Monthly Variable Sheet and placing those in the 12 month tabs or what is going in behind the 12 month tabs? Thank you in advance for your help!

yes, you’ll want to print 12 copies and those will go in the numbered tabs.

I’m confused how this works. Not sure what I’m missing. I wrote out bills due in December…so I take that monthly average & divide it by 2 because we get payed twice a month then pull that amount of money out of the next paycheck into a savings account? I don’t see how this makes a difference…can someone please help!